Company Rollovers

- Home

- Company Rollovers

Corporate Reconstructions

or Consolidations

An exemption may be available for transfers of dutiable property arising under a “corporate reconstruction” or “consolidation”

Specific requirements vary across states, but generally it encompasses transactions between members of the same “corporate group”and is not part of an arrangement for the principal purpose of accessing a duty concession or is part of a scheme.

A member of the corporate group must apply to the Commissioner for reconstruction relief. The exemption can apply to both companies and unit trusts.

Recent amendments have seen some limiting provisions enacted that could claw back more than just the duty that was exempted in WA.

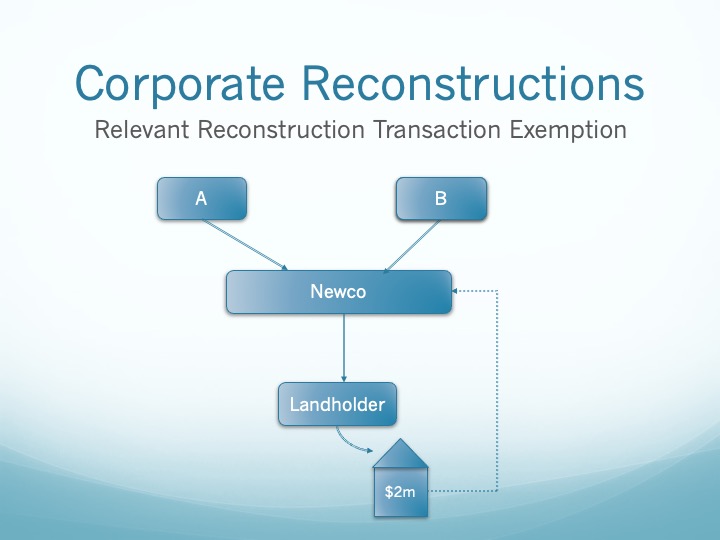

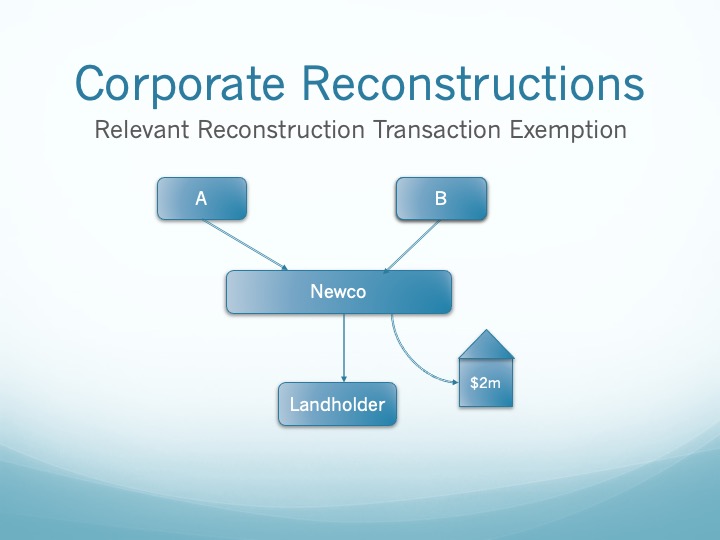

In its simplest form, the above example shows the transfer of land from the Landholder to the Newco. Newco may have recently been interposed because of a corporate consolidation. Pre and post conditions need to be satisfied.

Corporate Consolidation

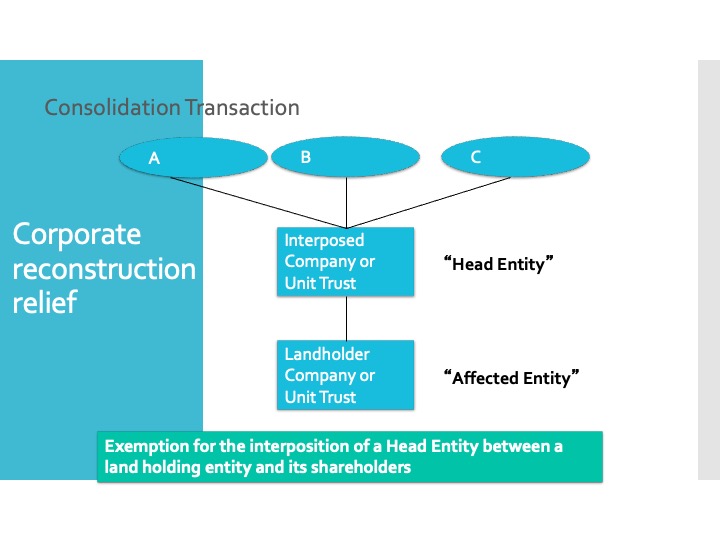

An exemption could be available for the interposition of a New Head entity between Shareholders and another company.

It may not be necessary that the interposition occurs between 2 companies of Trusts. It may occur between a company and 2 individual shareholders. However, the details need to be considered.

Points to Note

an automatic revocation of exemption if the transferee entity is removed from the family within three years after an exempt transaction; and still holds any of the dutiable property for which the exemption was received.

An exception is where it results from a public float. A person must notify the Commissioner within two months after the date of the event.

- After the Commissioner is notified about an event that triggers an automatic revocation of exemption, the Commissioner will issue an assessment for the dutiable property still held by the entity. The duty will be reduced by any landholder duty on the acquisition of the transferee entity to the extent it relates to land and chattels that were previously exempt.

Briefly, the Commisisoner will look at who provided the funds for the reconstruction.

The Commissioner will be unable to grant an exemption where part or all of the consideration for a relevant transaction (does this apply to a corporate consolidation?) is or will be provided by a non-family member. This does not include:

- consideration provided by a non-family member as a loan; or

- for consideration required to effect a corporate consolidation, consideration that is the acquisition of shares in the affected entity and an associated acquisition of shares in another entity.

If assets are located throughout Australia, then an application will need to be made in each jurisdiction. Goodwill is an example that may require multiple applications.

It is possible to obtain a pre transaction decision as to whether the Commissioner would allow a transaction if it were to proceed.

Should you undertake a pre-determination?

An application can be made up to 12 months after the relevant transaction. Care needs to be had to ensure the correct liability date is used.