Landholder

- Home

- Landholder

Very broadly, Landholder Duty, or Landrich duty relates to the liability to duty when an interest in a company or unit trust is acquired. The definition of acquire is broad, as are the aggregation provisions, for example you can acquire an interest simply by changing the rights to the shares, or be aggregated simply because 2 parties, otherwise unrelated, acquired shares together.

You need to speak to us before you enter into an agreement and the entity holds land interests (which could also mean fixtures)

Landholder duty is complex and the structure of the transaction can drive the extent of the liability such that each element needs to be considered, for example:

- Do you have a Heads of Agreement or Terms Sheet

- How is the consideration structured – cash, shares, liabilities, royalties

- Valuation issues

- Related party acquisitions ( Aggregation)

- Uncompleted contracts

- Fixed items to land

- Derivative Mining Rights

- Royalties

- Contingent, capped or milestone consideration

THE COMPLEXITY OF LANDHOLDER

The Examples below are taken from the Explanatory memorandum to the legislation produced by the government of WA in relation to the amendments in June 2019. They show it is now no longer a simple matter of asking does “the” company own land of $2,000,000 or more.

In fact, the extreme extension of the legislation is such that if a purchaser of a landholder goes to Bunnings and buys a wheel burrow within 12 months of acquiring the landholder, the chattel is at first deemed to be an aggregated chattel purchase that is grouped with the landholding entity and the wheel burrow could be assessed with duty … unless the Commissioner makes a determination it is not part of the one transactions ( s204F). Technically a submission is required (s14 Duties Act).

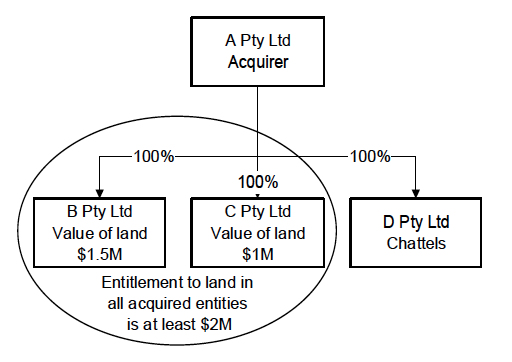

Landholder Aggregation to Liability

This example shows the reach of Landholder Duty when none of the acquired entities is a landholder in their own right ( A acquires B, C, and D). The total value of all land entitlements of the acquired entities is more than $2 million, which means there is a relevant arrangement in each case and B Pty Ltd, C Pty Ltd and D Pty Ltd are all landholders. Duty will be assessed on the total value of land and chattels held by B Pty Ltd, C Pty Ltd and D Pty Ltd ( note that C holds no land but only chattels and is also caught). |

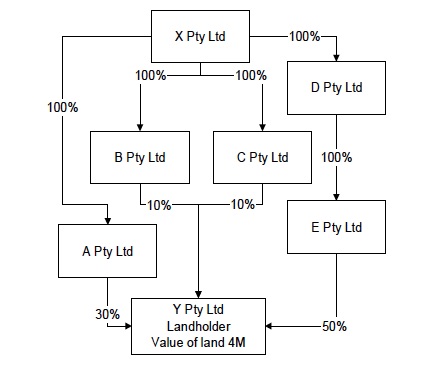

Looking Through and Linked Entities

X Pty Ltd acquires a 100 per cent interest in main entities A Pty Ltd, B Pty Ltd, C Pty Ltd and D Pty Ltd.

Each of the main entities has a direct or indirect interest in relevant entity Y Pty Ltd (subsection (1)(b)(i)).

The interest of each of A Pty Ltd, B Pty Ltd and C Pty Ltd in the relevant entity (Y) is less than 50 per cent. However, the aggregate interest the main entities have in the relevant entity (Y) is 100 per cent. Y Pty Ltd is taken to be linked to each of A Pty Ltd, B Pty Ltd and C Pty Ltd. It is already linked to D Pty Ltd. As such a Landholder obligation has arisen in relation to a 100% acquisition. As can be seen, care is needed when acquiring shares, as a look through may reveal a landholder obligation. |

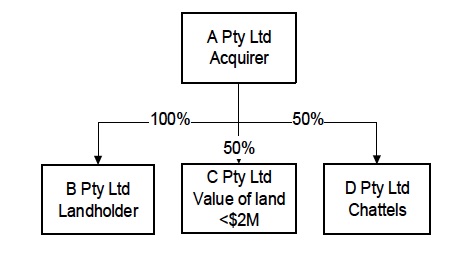

Acquiring a Landholder and non Landholder

|

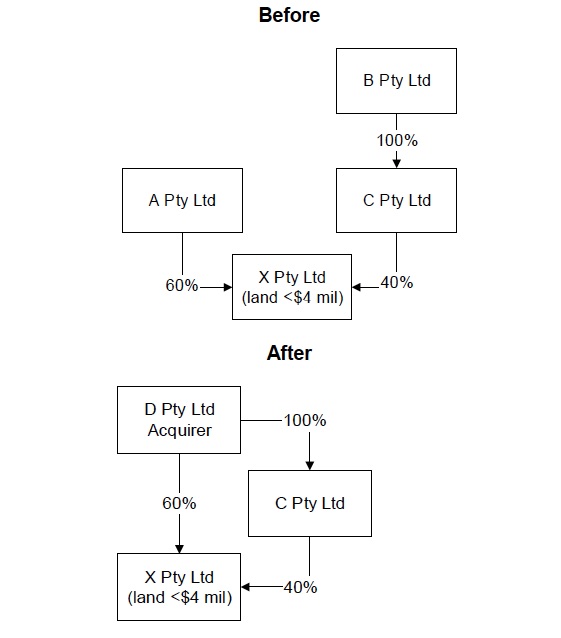

Linking Entities ( Indirect Acquisition)

D Pty Ltd acquires the 60 per cent interest of A Pty Ltd in X Pty Ltd and the 100 per cent interest of B Pty Ltd in C Pty Ltd. X Pty Ltd and C Pty Ltd are both main entities while X Pty Ltd is also the relevant entity. The interest of C Pty Ltd in X Pty Ltd is less than 50 per cent, and the aggregated direct or indirect interest of the main entities in the relevant entity is 100 per cent.

|

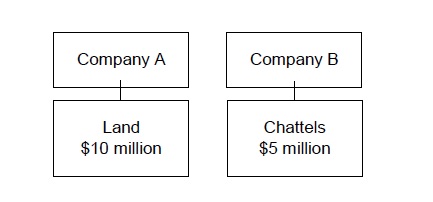

Landholder & Chattels

Company A holds land and Company B holds chattels that are used on Company A’s land (the example of Bunnings owning a wheel burrow and sells it). Company Z acquires an interest in Company A. As part of the same arrangement, Company Z acquires the chattels directly from Company B, rather than acquiring an interest in the entity. Under the current provisions, duty will apply to the landholder acquisition but not to the direct transfer of the chattels. However, the effect of amended section 14 is that the acquisition of chattels is a dutiable transaction. This is because the transfer of chattels forms part of one arrangement with the landholder acquisition in Company A. |